Coverage Solutions for Smokers and Alternate Tobacco Users

Cigar and alternate-tobacco users are one of most penalized segments of the life insurance customers, in terms of higher premiums. The term “alternate-tobacco” applies to non-cigarette smokers who consume anything nicotine related, smoked or not. This includes cigars, pipes, vaping, chewing tobacco, nicotine patches and to some extent, marijuana use (although marijuana can carry its own set of unique challenges/benefits depending on the carrier).

A proposed insured who smokes an occasional cigar (with a positive specimen) or someone who vapes (a rapidly growing percent of adults) will be charged smoker rates by most life carriers. Since vaping is still a new phenomenon, and long-term effects have yet to be fully studied, the jury is still out on whether long-term use of e-cigarettes affects mortality similar to other tobacco products. As marijuana continues to be legalized in multiple states carriers have had to adjust their underwriting methods to deal with the recent influx of marijuana users.

At GBS Insurance, we have markets that are extremely flexible when it comes to underwriting those risk classifications, and can assist you in obtaining nonsmoker and, many times nonsmoker plus, rate classifications.

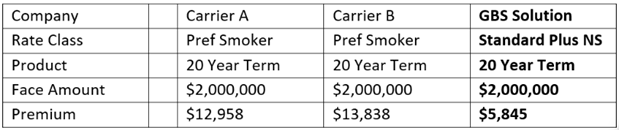

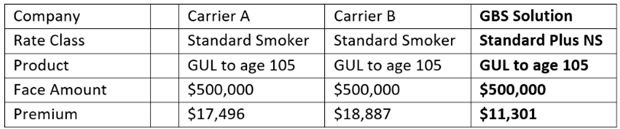

The following are two case studies that highlights the savings possible when these alternate-tobacco scenarios are handled with care.

Case Study #1: Male, age 50, healthy, preferred risk class, but VAPES on a regular basis:

GBS was able to save the client over $7000 by identifying the correct Vape-friendly carrier.

Case Study #2: Male age 61, Fair health, smokes 2 cigars a week, positive nicotine results:

GBS was able to save the client over $6000 by suggesting the right carrier for cigar smokers.

In addition, your clients may be overpaying for their life insurance coverage based on:

- Date of cessation of cigarette usage

- Frequency of use, even with negative nicotine results

- Chewing tobacco

- Using Nicorette Gum

- Marijuana usage (much more liberal underwriting today)

GBS Insurance has the knowledge, resources, underwriting expertise to guide you through this smoky maze to insure your client receives the most favorable possible underwriting result and rate class. Call your GBS Marketer to discuss any new or previously underwritten life opportunity where tobacco usage or alternate usage may be applicable 800-473-5966.